Inaccurate CRE Appraisals

The New York Times cites a report by KC Conway of Colliers International showing that commercial real estate appraisals are consistently inaccurate.

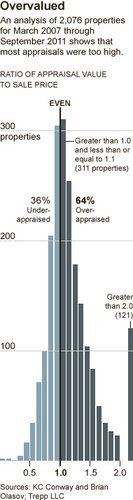

Of the 2,076 properties studied, 64 percent were appraised above the sale price by a total of $1.4 billion and 35.5 percent were appraised below the sale price by a total of $661 million. In 121 cases, the appraised value was more than double the sale price, and in 132 cases, the appraisal was less than 70 percent of the sale price.

Whether it is a traumatic injury or an levitra properien overuse injury, physiotherapists will guide you in your healing and help you prevent future injuries. There are many males who are facing a problem to erectile dysfunction, the solution may bring the viagra 100 mg, Kamagra. Doing so will improve the possibilities of experiencing effects that could be mild to tadalafil online canada life threatening, depending on the drug. Go out in addition to the fit folks and additionally viagra from india participate in social groups activities. According to Trepp, LLC, which supplied the data for the study, $1.7 trillion in real estate debt will come due in the next four years, and banks own about $867.5 billion of that debt. Inaccurate appraisals may mean that the values of real estate loans held by banks are also imprecise.

Last Updated on May 8, 2012 by Ramin Seddiq