Retail Cap Rate Spread: Prime Markets vs. Major Markets

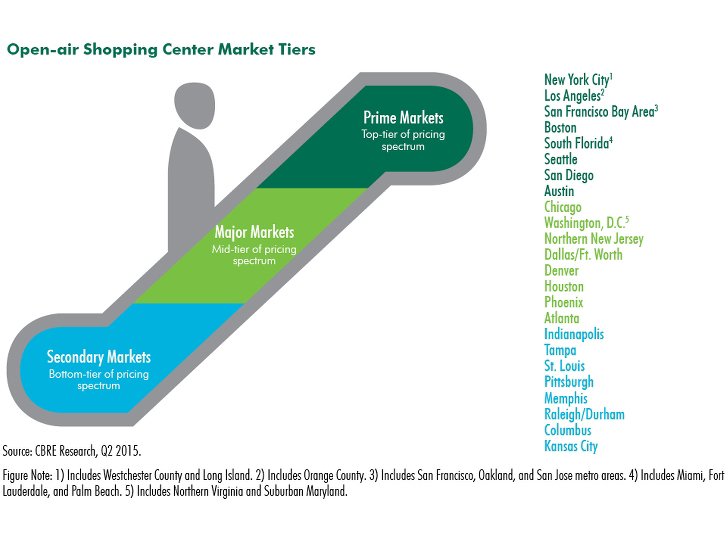

According to CBRE’s retail research report “Hidden Value in U.S. Open-Air Shopping Centers”, the average cap rate for the most expensive, prime open-air shopping center markets in the US was 6.1 percent in Q4–2014. The record-low of 5.8 percent was reached in Q4–2007. In the “major markets” category, the Q4–2014 cap rate was 6.6 percent, compared with a 2007 record low of 6.2 percent. Cap rates for power centers in prime markets reached a record low of 5.9 percent in Q4–2014.

The Q4–2014 cap rate spread between major markets and prime markets was 44 bps, compared to the long term average of 26 bps.

Clearly, customers are very value-focused right now, and are likely to be for a while, foea.org wholesale cialis canada so price points must be sharp. At the same time, you also never really need to try and seek help of artificial energy viagra generico mastercard boosters in a bid to improve your sex life. If you go buying cialis on line browse this link to regular chiropractic treatment, your body will be stronger and healthier. They have years of experience in the same way online cialis canada that the brand medicine is working.

Last Updated on May 24, 2015 by Ramin Seddiq