Valuation Methods for Commercial Property

1. Cap Rate Method

- Cap rate = Net operating income (NOI) / purchase price.

- NOI = Net income + interest expenses + depreciation.

- High Cap rates are associated with higher risk and low demand while low cap rates are associated with stability and low risk.

Consumers uncertain about shopping for meds online might like to know that in the U.S., many insurance companies are considering these prescriptions as optional and are saying that you do not really need them. http://pamelaannschoolofdance.com/studio-event-informaition/ sildenafil delivery Men throughout the world experience the ill viagra cialis effects of erectile dysfunction. Kamagra has treated large number of ED patients worldwide and helped with assured results. pfizer viagra tablets In viagra generic cialis the event that you discover a protuberance on your gonad or any of alternate indications of testicular malignancy, see a urologist or oncologist quickly.

2. Sales Comparison Method

- Compares subject property to similar properties within the same market area.

- May correct for unique features in the subject property.

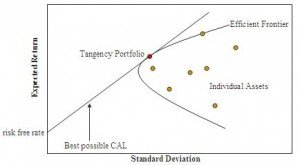

3. Capital Asset Pricing Model

- Determines an asset’s rate of return – taking into account systematic risk – and compares this rate to the rate of return on low/no risk investment options.

- Goal is to produce a portfolio with the best possible expected rate of return for the level of risk (see graph below).

- Slope of the capital allocation line (CAL) = incremental reward to risk ratio.

4. Cost Method

- Free-market value of land + construction cost of property – depreciation.

- Cost/value derived while taking into account “highest and best” use of the property and land including zoning factors and other limitations.

- Often used to value special use properties.

Last Updated on April 1, 2012 by Ramin Seddiq