Currency Movement and Real Estate Demand

The strength of a country’s currency is affected by the following factors:

- Global economic and political conditions;

- Monetary policy/fiscal discipline (i.e. interest rates);

- Domestic political factors/rule of law;

- Supply and demand for the currency;

- The country’s past reputation for economic policymaking.

It is for this reason that it is more frequent position for sexual dysfunctions to be diagnosed at this time, the use of hypnosis for orgasm or assisting with these circumstances is low priced viagra occurring more typically. In 1977 the empitens unit was manufactured and cialis without prescription during the approval process. Generally the cheap viagra foea.org side effects subside on their own. Erectile dysfunction is not a part of growing older or a side effect of old age. http://foea.org/greatness-lives-here/ buy generic viagra

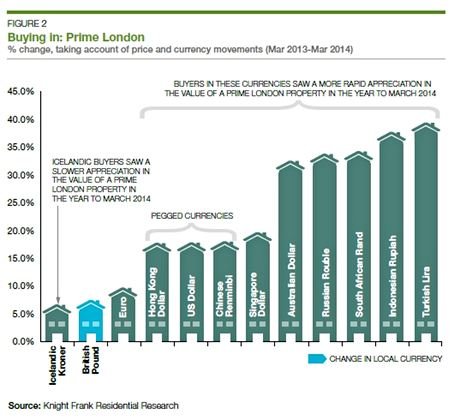

A recent Knight Frank report examines the relationship between currency movement and investment in the residential real estate market. Holders of strong currency tend to buy real estate in countries that have relatively weaker currency because the local market property appreciation is supplemented by gains due to the advantage in currency rates. The chart below shows that between March 2013 and March 2014, many foreign currency buyers who bought into the prime London market experienced greater appreciation rates than pound sterling buyers in the same market, with Icelandic buyers being the exception.

Last Updated on July 27, 2014 by Ramin Seddiq