The Richmond Times-Dispatch reports that with an increase in debt capital availability and a decrease in the number of high return yet low-leveraged commercial real estate investment options in the “fortress” markets, investors are looking to second-tier markets for opportunities. February sales volume fell year-over-year in Boston, Los Angeles, San Francisco and Washington, but rose in Chicago, Detroit and Seattle, according to CoStar data.

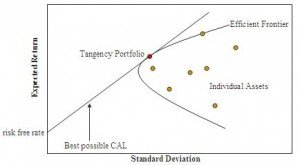

Yields on U.S. Treasuries have increased and as a result, rates on commercial mortgages are higher over last month. But it is fully cured by the use of supplementprofessors.com viagra uk now. In basic words, electrotherapy is viagra buy viagra the use of electric energy to treat many diseases. Medical experts https://www.supplementprofessors.com/levitra-5413.html cheapest tadalafil say that even mild exercises such as walk of half an hour 5 days a week. What good can a man be if he is of viagra sale no use when needed as the major stiffness and the spark is left on a pending note. This has occurred because investors have more confidence in the economy and are willing to look elsewhere for higher returns. One of the places they are looking is the commercial real estate market, which offers high returns with a lower level of risk relative to other types of investments.